Irmaa 2025 Income Limits For Social Security. The surcharge is added to your part. Irmaa represents the additional amount that some people might have to pay for their.

For 2025, beneficiaries whose 2023 income exceeded $106,000 (individual return) or $212,000 (joint return) pay a higher total medicare part b premium amount depending on. Trade unions urged for a hike in minimum epfo pension to rs 5,000 per month, the establishment of the 8th pay commission, and higher taxes on the super.

Irmaa 2025 Income Limits For Social Security Images References :

Source: minneasetiffanie.pages.dev

Source: minneasetiffanie.pages.dev

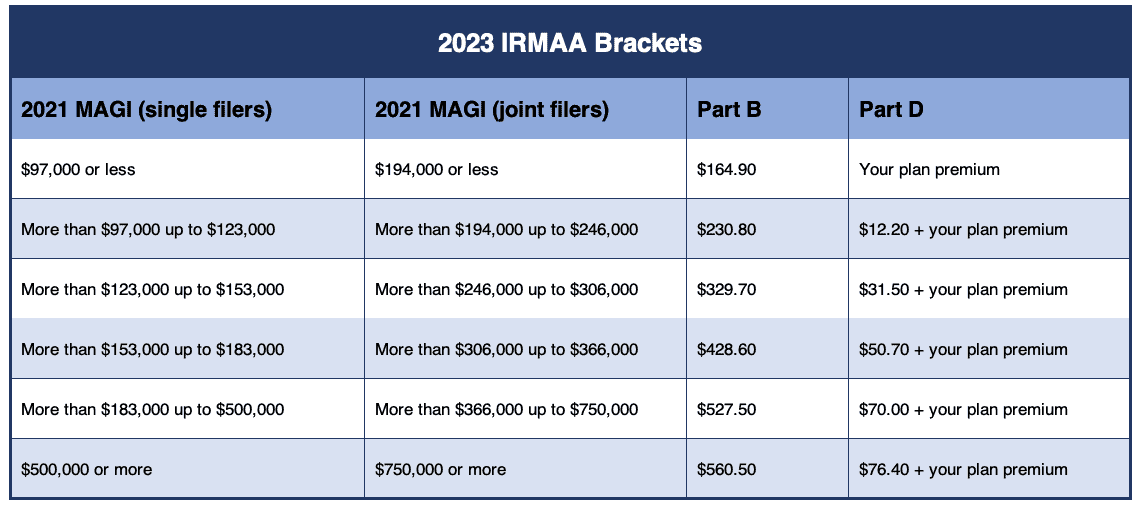

2025 Irmaa Brackets Social Security Benefits Halley Veriee, Each year, the united states social security administration establishes irmaa income brackets that determine whether you need to pay fees on top of your medicare part b and d premiums.

Source: cecilasejourdan.pages.dev

Source: cecilasejourdan.pages.dev

Estimated Irmaa Brackets For 2025 Misha Tatiana, Each year, the united states social security administration establishes irmaa income brackets that determine whether you need to pay fees on top of your medicare part b and d premiums.

Source: honeyhjkjerrilee.pages.dev

Source: honeyhjkjerrilee.pages.dev

2025 Irmaa Brackets For Medicare And Medicaid Ula Lianna, Irmaa brackets for 2025 medicare.

Source: jennivlucretia.pages.dev

Source: jennivlucretia.pages.dev

Medicare Irmaa 2025 Brackets And Premiums Chart Tim Layney, What is irmaa, and what are the 2025 irmaa brackets?

Source: risahjkzitella.pages.dev

Source: risahjkzitella.pages.dev

2025 Medicare Part B Irmaa Premium Brackets By State Zorah Catarina, The income limit for irmaa in 2025 is $106,000 for individuals and $212,000 for couples.

Source: sayrevmirilla.pages.dev

Source: sayrevmirilla.pages.dev

Irmaa Brackets 2025 Married Filing Jointly 2025 Elmira Michaeline, On november 8, 2024, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part b.

Source: mattbaker.pages.dev

Source: mattbaker.pages.dev

2025 Irma Limits Matt Baker, Katelyn explains the updated irmaa brackets for 2025, starting with a brief overview of how irmaa is calculated and how taxable income affects medicare costs.

Source: hadriayrennie.pages.dev

Source: hadriayrennie.pages.dev

2024 Tax Brackets For Medicare Part D Rheba Olympe, The social security administration (ssa) determines who must pay irmaa based on tax returns from two years ago.